-

India Fintech Vision 2030: Powering a $10 Trillion Digital Economy

India’s Fintech Vision 2030 places financial technology at the core of national transformation. As India moves toward becoming a $10+ trillion economy, fintech is no longer an enabler—it is the engine driving financial inclusion, digital governance, cashless commerce, and global financial leadership. By 2030, India is expected to host the world’s most advanced, inclusive, and

-

New Threats to National Security in India’s Growing Fintech & Digital Economy

Introduction: India’s Digital Rise Comes With New Risks India is witnessing an unprecedented transformation powered by fintech, digital payments, AI, blockchain, and data-driven governance. From UPI transactions crossing billions every month to rapid adoption of digital lending, wealth tech, and embedded finance, the country is moving fast toward a cashless and decentralized digital economy. However,

-

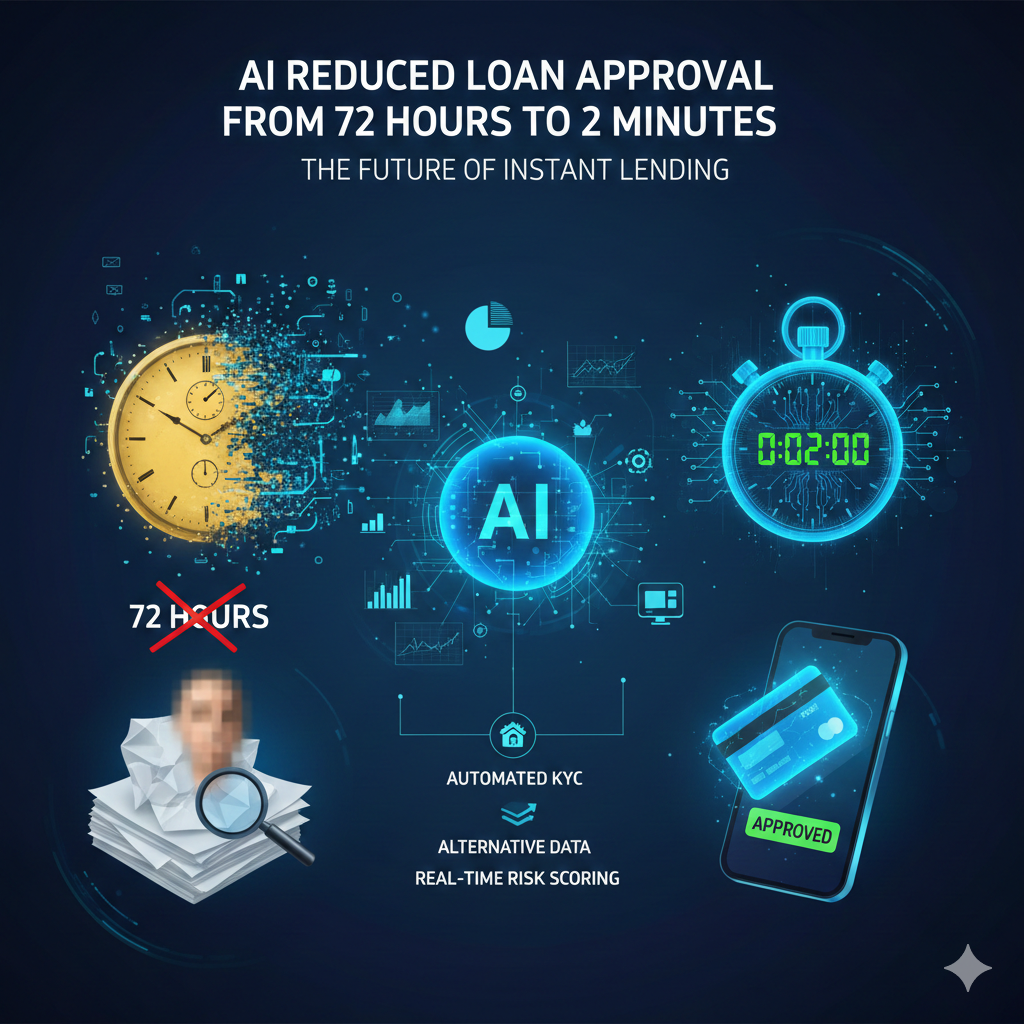

AI Reduced Loan Approval from 72 Hours to 2 Minutes: A Deep Dive Into the Future of Instant Lending

AI Reduced Loan Approval from 72 Hours to 2 Minutes: A Deep Dive Into the Future of Instant Lending The lending industry has undergone a massive transformation in the last few years. What once required manual verification, branch visits, paperwork, and 72+ hours of approval time has now been compressed into a lightning-fast, fully automated

-

Inside India’s API Revolution: The Invisible Engine Powering Fintech

Inside India’s API Revolution: The Invisible Engine Powering Fintech APIs (Application Programming Interfaces) have quietly become the most powerful force driving India’s fintech boom. While consumers interact with simple, fast, and seamless digital financial services, the real magic happens behind the scenes—powered by APIs that connect banks, fintechs, regulators, and digital platforms in real time.

Recent Posts

- India Fintech Vision 2030: Powering a $10 Trillion Digital Economy

- New Threats to National Security in India’s Growing Fintech & Digital Economy

- AI Reduced Loan Approval from 72 Hours to 2 Minutes: A Deep Dive Into the Future of Instant Lending

- Inside India’s API Revolution: The Invisible Engine Powering Fintech

- AI in Financial Services: Real Applications, Regulation, Efficiency Gains & Risks

Tags

AI governance AI in finance AI in securities market AI Reduced Loan Approval AI risks in finance artificial intelligence data quality in AI systems Hyper-personalized financial Instant identity verification manual verification Paperless lending payment tokenization Secure data sharing token vault UPI APIs