-

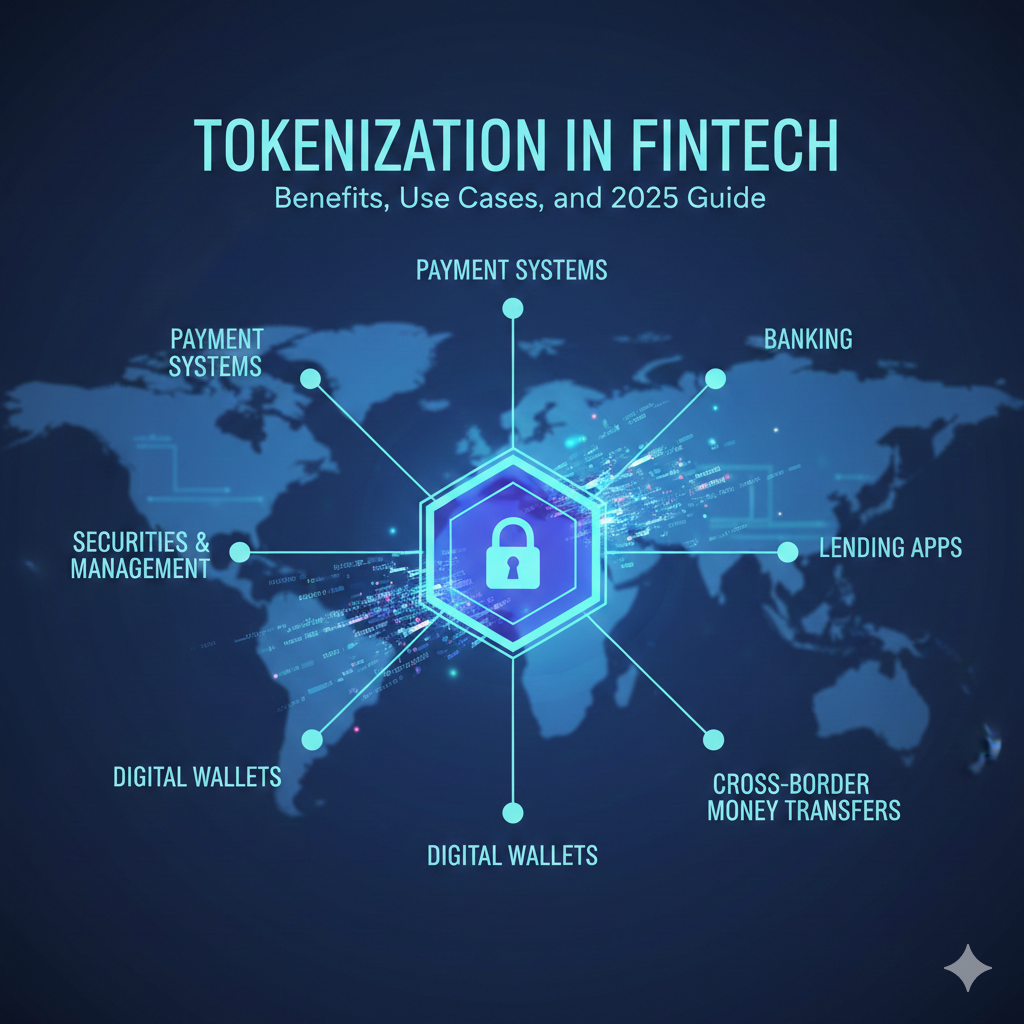

Tokenization in Fintech: Benefits, Use Cases, and 2025 Guide

Tokenization in Fintech: Benefits, Use Cases, and 2025 Guide Tokenization in fintech refers to replacing sensitive financial information—such as card numbers, account details or identity data—with a secure, random token. This token is useless to attackers and carries no meaningful pattern or link to the original data. This process helps protect customer information in: Because

Recent Posts

- India Fintech Vision 2030: Powering a $10 Trillion Digital Economy

- New Threats to National Security in India’s Growing Fintech & Digital Economy

- AI Reduced Loan Approval from 72 Hours to 2 Minutes: A Deep Dive Into the Future of Instant Lending

- Inside India’s API Revolution: The Invisible Engine Powering Fintech

- AI in Financial Services: Real Applications, Regulation, Efficiency Gains & Risks

Tags

AI governance AI in finance AI in securities market AI Reduced Loan Approval AI risks in finance artificial intelligence data quality in AI systems Hyper-personalized financial Instant identity verification manual verification Paperless lending payment tokenization Secure data sharing token vault UPI APIs