Tokenization in Fintech: Benefits, Use Cases, and 2025 Guide

Tokenization in fintech refers to replacing sensitive financial information—such as card numbers, account details or identity data—with a secure, random token. This token is useless to attackers and carries no meaningful pattern or link to the original data.

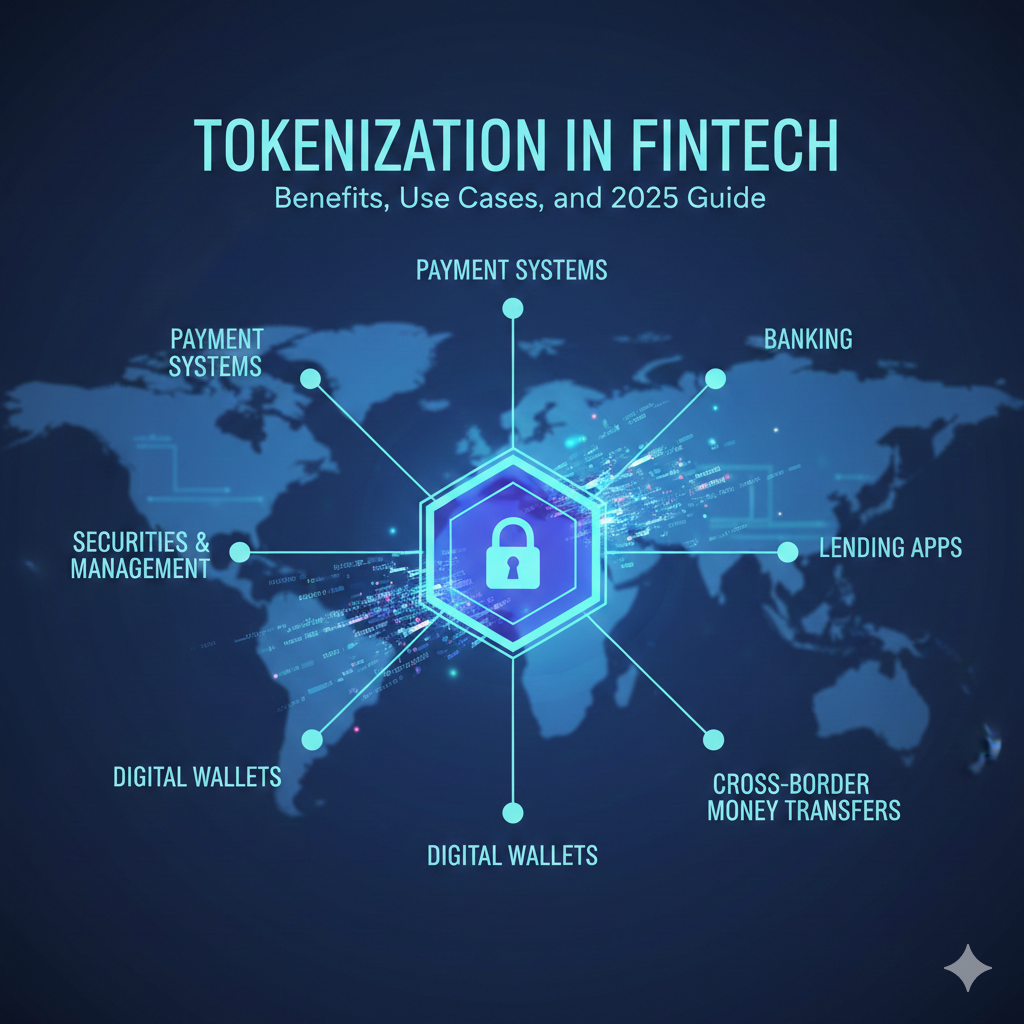

This process helps protect customer information in:

- Payment systems

- Banking apps

- Lending platforms

- Digital wallets

- Securities and asset management

- Cross-border money transfers

Because tokenization doesn’t expose the original data, it significantly reduces fraud risk and ensures financial institutions remain compliant with regulations like PCI DSS, RBI tokenization guidelines, and PSD2.

Key Highlights of Tokenization

| Key Area | Details |

| Primary Function | Replaces sensitive financial data with secure tokens |

| Used in | Card tokenization, digital wallets, open banking, asset tokenization |

| Benefits | Lower fraud risk, PCI compliance, secure digital payments |

| Core Component | Token vault / secure vault |

| Industry Examples | Visa Token Service, MasterCard MDES, Apple Pay, Google Pay |

| Popular Token Types | Payment tokens, asset tokens, identity tokens, bank account tokens |

| Best For | E-commerce companies, fintech apps, banks, lenders, digital wallets |

| Regulatory Support | RBI, PCI DSS 4.0, European PSD2, MAS |

Why Tokenization Matters in Fintech

Payment fraud, data breaches, and account theft have dramatically increased in recent years. To protect customers and reduce financial risk, fintech companies now rely heavily on payment tokenization and banking tokenization.

SEO-Focused Benefits:

- Protects card and account data

- Enables safe card-on-file storage

- Supports secure UPI and wallet payments

- Helps meet PCI DSS and RBI compliance

- Reduces card-not-present fraud

- Improves customer trust in digital payments

The growth of tokenized payments and tokenized assets reflects a larger industry shift toward stronger, backend-level infrastructure security.

How Tokenization Works in Fintech (Step-by-Step)

Understanding the workflow helps explain why businesses prefer this over other security models.

Step 1: User Submits Data

The customer enters card details, bank information, or identity data during a transaction or onboarding.

Step 2: Tokenization Request

This data is sent securely to a token service provider (TSP), such as Visa, Mastercard, a bank, or a fintech company.

Step 3: Token Vault Stores the Original Data

The sensitive information is stored in a high-security token vault.

Step 4: A Random Token Is Created

The system generates a token with no mathematical or visible connection to the original data.

Step 5: Token Replaces Sensitive Data

Merchants or apps use the token instead of the real card or account number.

Step 6: De-tokenization

When required, only authorized systems can map the token back to the original information.

This process keeps financial data safe even if databases or networks are compromised.

Types of Tokenization in Fintech

Tokenization is used across multiple verticals in the financial ecosystem.

a. Payment Tokenization

Most popular type used for:

- Card tokenization for UPI

- Mobile wallet payments

- Tap-and-pay NFC transactions

- Recurring billing

- Digital checkout flows

b. Asset Tokenization

Used for converting real-world assets into secure digital representations:

- Tokenized bonds

- Tokenized real estate

- Tokenized gold

- Tokenized equity

- Tokenized funds

c. Security Tokenization (Regulated Financial Assets)

Used in capital markets to issue:

- Tokenized securities

- Tokenized debt

- Digital bonds

d. Identity Tokenization

Protects sensitive customer identity information:

- KYC data

- Aadhaar/ID numbers

- Biometrics

- Verification records

e. Bank Account Tokenization

Used in:

- Open banking APIs

- Account-to-account payments

- Virtual account systems

6. Benefits of Tokenization in Fintech

Below are the strongest reasons fintech companies rely on tokenization:

1. Higher Payment Security

Tokenized payments help protect against:

- Card-not-present fraud

- Database breaches

- Man-in-the-middle attacks

2. PCI DSS Compliance

Tokenization reduces the compliance burden for companies handling card data.

3. Occurrence-Free Online Payments

Supports:

- Faster checkouts

- Saved cards

- Auto-renewals

- Subscription billing

4. Reduces Fraud in E-commerce

Merchants store tokens instead of raw card numbers, eliminating risk exposure.

5. Essential for Digital Wallets

Apple Pay, Google Pay, Samsung Pay, and UPI card tokens operate entirely on tokenization.

6. Enables New Business Models

Asset tokenization opens pathways for:

- Fractional real estate

- Tokenized securities trading

- Global liquidity access

7. Use Cases: Where Tokenization Is Used in Fintech

1. Tokenized Payments in E-Commerce

- Saved cards for checkout

- High-risk transaction protection

- Subscription billing

2. Digital Banking

- Tokenized account numbers

- Virtual account systems

- API-based open banking

3. Capital Markets

- Digital bond issuance

- Tokenized equity

- Fractional asset ownership

4. Lending Platforms

- Tokenized income data

- Secure underwriting

- Protected collateral records

5. Insurance Sector

- Tokenized policyholder identity

- Tokenized medical records

- Secure claim sharing

6. Cross-Border Transactions

- Tokenized bank identifiers

- Secure remittance channels

8. Tokenization vs Encryption

| Tokenization | Encryption |

| Replaces data with random token | Converts data using cryptography |

| No mathematical link | Can be decrypted |

| Ideal for payments & identity | Ideal for messaging & storage |

| Zero value if breached | Encrypted data may still be valuable |

| Requires token vault | Requires encryption key management |

9. Regulatory Support for Tokenization

India

- RBI card tokenization mandatory for merchant sites

- UPI card tokenization rollout

- Data minimization rules

USA

- PCI DSS 4.0

- SEC tokenization pilots

European Union

- PSD2

- MiCA for digital assets

Singapore, UK, UAE

Strong institutional support for asset tokenization and tokenized securities.

10. Challenges of Tokenization in Fintech

Even though tokenization is powerful, it has limitations:

- Lack of universal standards

- Vault scalability and performance issues

- Complex system migration

- Regulatory differences across countries

- Vendor lock-in risks

11. Future of Tokenization in Fintech

Tokenization will play a key role across banking, payments, and capital markets in the coming decade.

Future Trends:

- Tokenized cash flows and settlements

- Enterprise adoption of token vault infrastructure

- Tokenized government bonds

- Tokenized compliance systems

- Cross-border tokenized liquidity

Tokens will be used to move value, protect identity, manage payments, and operate global-scale digital finance systems.