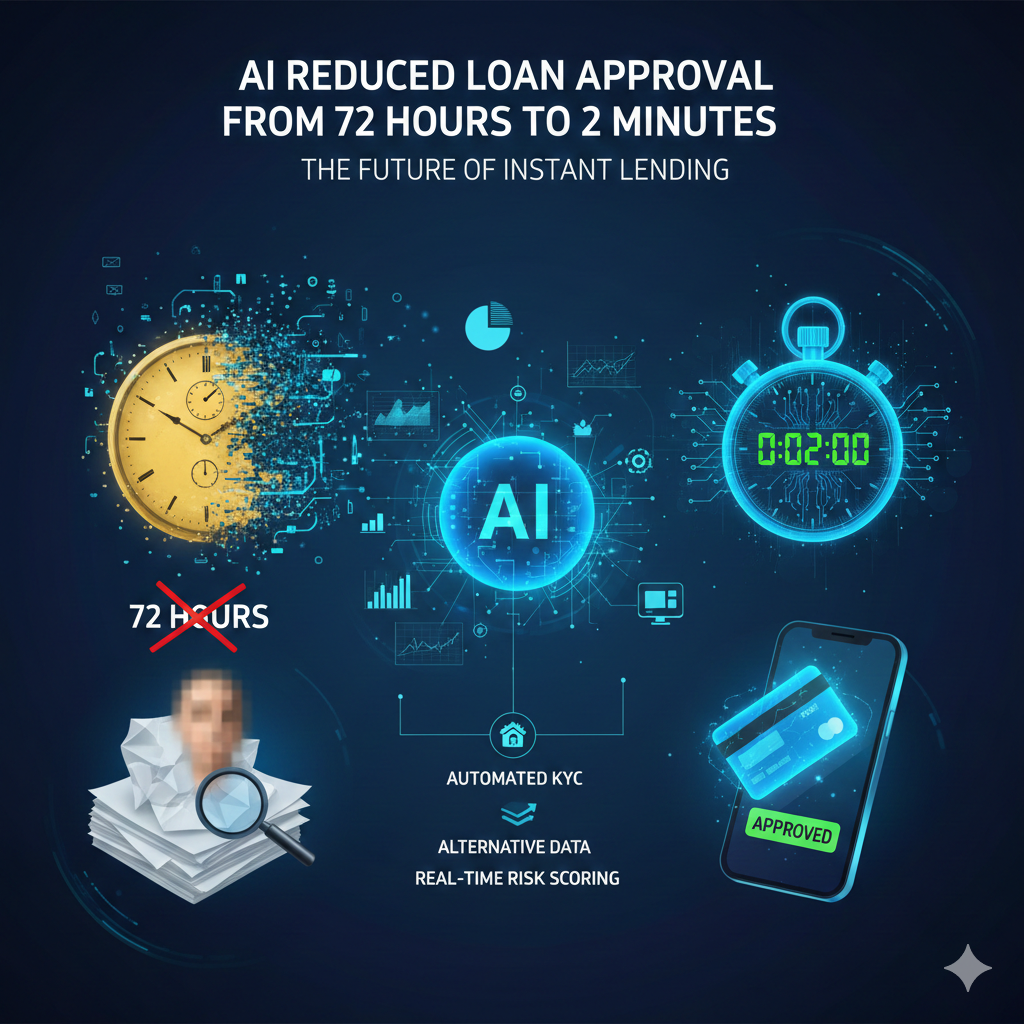

AI Reduced Loan Approval from 72 Hours to 2 Minutes: A Deep Dive Into the Future of Instant Lending

The lending industry has undergone a massive transformation in the last few years. What once required manual verification, branch visits, paperwork, and 72+ hours of approval time has now been compressed into a lightning-fast, fully automated 2-minute loan approval journey—powered entirely by AI, automated KYC, alternative data models, and real-time risk scoring.

This blog explores how fintech companies achieved this breakthrough, the technology stack, real-world use cases, KPIs, and the future of AI-driven credit decisioning.

⭐ Introduction: The Evolution of Digital Lending

Before AI entered the lending ecosystem, banks and NBFCs relied on manual assessment, physical documents, human-driven verification, and long underwriting cycles. Customers disliked the waiting period while lenders struggled with operational inefficiencies.

Enter AI-powered digital lending.

Today, most fintech lenders in India and across the world leverage:

- Artificial Intelligence

- Machine Learning (ML)

- Video & Digital KYC

- OCR and Document Parsing

- Behavioural & Alternative Data

- Real-Time Identity Verification

- Automated Rule Engines

- Instant Credit Risk Scoring

These technologies combine to create a lending journey that is fast, data-driven, accurate, and scalable.

⭐ How AI Brought Loan Approval Time Down From 72 Hours to 2 Minutes

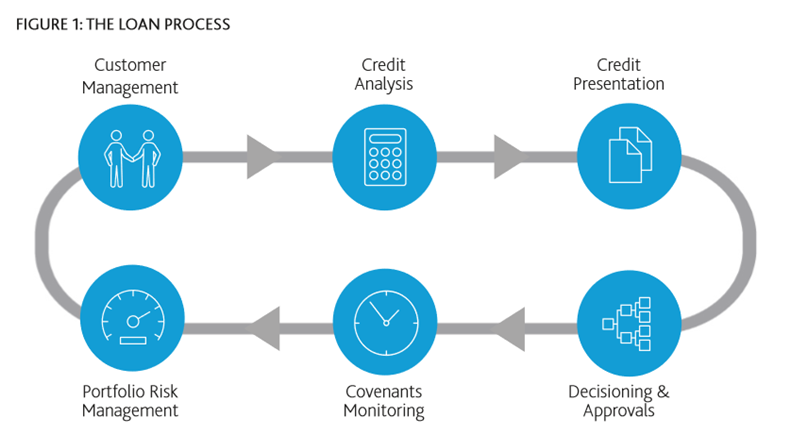

AI optimizes the lending flow in four major stages:

- Instant Identity Verification (KYC)

- Automated Document Analysis

- AI/ML Credit Risk Scoring

- Real-Time Loan Decisioning

Let’s explore each stage in detail.

1. Automated KYC: From Manual Checks to 30-Second Verification

Manual KYC traditionally involved:

- Branch visits

- Human validation

- Multiple documents

- Risk of fraud

AI transforms this experience using:

✅ Video KYC

Liveness detection, facial recognition, and digital signatures confirm identity.

✅ OCR & Document Parsing

AI extracts name, DOB, address, Aadhaar details, and PAN numbers in seconds.

✅ Fraud Prevention

The system uses global databases, watchlists, and pattern recognition to prevent identity fraud.

Time saved:

Manual = 24–48 hours

AI KYC = 10–30 seconds

2. AI-Driven Document Verification & Income Assessment

AI eliminates the need for manual document review using:

- OCR for bank statements

- Categorization of income vs expenses

- Salary slip extraction

- GST return data

- ITR-based income recognition

- Employment history validation

Outcome: Faster and more accurate income assessment.

3. Risk Scoring Models That Replace Traditional Credit Scores

Traditional credit scores (CIBIL, Experian) provide a limited picture.

AI expands this by analyzing over 500+ data points, including:

📌 Alternative Data Inputs:

- Mobile usage pattern

- App installation profile

- SMS financial data

- E-commerce behaviour

- UPI transaction history

- Repayment behaviour with other lenders

- Geolocation stability

- Device fingerprinting

📌 Machine Learning Models Used:

- Logistic Regression

- Random Forest

- Gradient Boosting

- Deep Learning

- Ensemble Scoring Mechanisms

These models allow lenders to approve borrowers—even thin-file or new-to-credit customers—with high confidence.

4. Real-Time Decision Engine (2 Minutes or Less)

A rule engine + ML model takes all the data points and decides:

- Loan eligibility

- Maximum loan amount

- Tenure

- Interest rate

- Fraud signals

- Risk category

This happens instantly on the backend, while the end user sees an approval within seconds.

Time saved:

Traditional underwriting = 72 hours

AI-powered underwriting = 2 minutes

⭐ Comparison Table: Traditional Lending vs AI-Driven Instant Lending

| Process Step | Traditional Lending (Manual) | AI-Driven Instant Lending | Time Saving |

| KYC Verification | Physical docs, branch visits | Automated Video KYC, OCR | 48 hrs → 30 sec |

| Document Review | Manual verification | AI document parsing | 24 hrs → 20 sec |

| Credit Scoring | Based on CIBIL | AI assesses 500+ data points | 12 hrs → Instant |

| Fraud Checks | Limited, manual | Real-time pattern detection | Hours → Instant |

| Loan Decision | Human underwriter | Automated rule engine | 24 hrs → 10 sec |

| Disbursement | Batch processing | API-based instant disbursement | 4 hrs → 30 sec |

Total Time:

Traditional = 72+ hours

AI-Powered = 2 minutes

⭐ The Tech Stack Behind the 2-Minute Loan Approval

Below is a detailed breakdown of the modern fintech tech stack:

1. Frontend Layer (User Onboarding)

- Mobile app / web app

- Loan eligibility form

- Document upload module

- KYC module

- Consent collection

Technologies: React, Next.js, Flutter, Swift

2. Identity Verification Layer

- Aadhaar XML / eKYC

- Video KYC

- Biometric verification

- Face match API

- Fraud detection API

Popular providers:

Signzy, Hyperverge, Au10tix, FRS Face Recognition

3. Data Aggregation & Parsing Layer

- Bank statement analyzer (Perfios, Karza)

- GST & ITR APIs

- PAN verification

- UPI transaction insights

- SMS data parser

4. AI/ML Risk Engine

Core features:

- Probability of Default (PD)

- Debt-to-Income Ratio (DTI)

- Behavioural scoring

- Social scoring

- Employment stability

- Fraud probability

ML Tools:

- Python

- TensorFlow

- PyTorch

- Scikit-Learn

- Gradient boosting frameworks (XGBoost, LightGBM)

5. Decision Engine

Decision-making rules include:

- Income thresholds

- Age limits

- Geolocation risk

- Existing liabilities

- Borrower behaviour

Once AI approves, loan terms are auto-generated.

6. Disbursement Layer

- Bank-to-bank IMPS/NEFT APIs

- UPI autopay setup

- eMandate (NACH / eNACH)

- Loan agreement e-signing

Platforms: RazorpayX, PayU, Cashfree, M2P, Decentro

Result: Money reaches customer account within seconds.

⭐ Case Study: How One Fintech Reduced Approval Time to 2 Minutes

A leading Indian fintech lender implemented an AI-first lending model in 2024.

Before AI, their loan approval time was:

- Average: 72 hours

- Rejection rate: 35% (mostly due to incomplete documents)

- Operational cost per loan: ₹110

After implementing AI:

📌 KPIs (Before vs After)

| Metric | Before AI | After AI | Improvement |

| Loan Approval Time | 72 hrs | 2 min | 99% faster |

| Customer Drop-Off Rate | 60% | 18% | 70% lower |

| Cost per Loan | ₹110 | ₹22 | 80% lower |

| Fraud Cases | 4.5% | 1.2% | 73% reduction |

| Loan Approval Rate | 65% | 82% | 26% increase |

This proves how AI transforms lending efficiency, safety, and profitability.

⭐ Benefits of AI-Driven Instant Loan Approval

1. Faster Customer Onboarding

Users can apply, upload documents, and get approval in minutes.

2. Higher Accuracy

AI eliminates human errors and bias.

3. Lower Operational Costs

Banks and NBFCs can scale without increasing staff.

4. Fraud Reduction

Machine learning identifies abnormal patterns instantly.

5. Improved Financial Inclusion

People with low credit history also get loans.

6. Higher Customer Satisfaction

Fast loan disbursal enhances user trust and retention.

⭐ Challenges in AI-Based Lending (and How Fintech Solves Them)

1. Data Privacy Concerns

Solution: End-to-end encryption, tokenization, consent-based access.

2. Model Bias

Solution: Fairness testing, bias detection layers, human oversight.

3. Regulatory Complications

Solution: RBI-compliant digital lending norms, transparent disclosures.

4. Model Drift

Solution: Continuous model retraining to stay updated.

5. System Integration

Solution: Modular microservices architecture with secure APIs.

⭐ The Future of AI in Lending (2025–2030)

The next evolution of instant lending will focus on:

🔹 1. Predictive Lending

AI will predict when users need money before they apply.

🔹 2. Hyper-Personalized Loan Offers

Customized interest rates based on real-time behaviour.

🔹 3. 10-Second Loan Approval

AI models are expected to shrink the 2-minute process further.

🔹 4. Blockchain-Based KYC

Decentralized identity verification for global lending.

🔹 5. GenAI in Underwriting

AI agents performing end-to-end underwriting.

🔹 6. Zero Human Involvement Lending

Full automation from onboarding → approval → disbursement.